®

®

OTTO™'s Auto Insurance Guide

Welcome to OTTO™’s comprehensive guide to auto insurance, where we provide you with all the essential information you need to know about auto insurance policies!

Auto Insurance: Protecting Your Ride and Wallet

Auto insurance is your financial safety net on the road. Whether you’re a seasoned driver or just became a vehicle owner, it’s crucial to understand the ins and outs of auto insurance to protect yourself, your vehicle, and your finances. OTTO™ has put together an in-depth overview knowing that being informed is the key to making smart choices about your auto insurance.

Understanding Key Coverage Types

• Liability Insurance: Covers injury and property damage you cause to others in an accident.

• Collision Insurance: Pays for damage to your own vehicle in the event of a collision, regardless of fault.

• Comprehensive Insurance: Provides protection against non-collision events like theft, vandalism, or natural disasters.

• Uninsured/Underinsured Motorist Coverage: Steps in if you’re in an accident caused by a driver who doesn’t have insurance or doesn’t have enough coverage to pay for your damages.

Considering Premium Factors:

OTTO™ is here to help you get the best deal for the coverage you choose. Still, it is important to know that your insurance premiums are influenced by several factors, including:

Driving History: Safe drivers often enjoy lower rates.

Vehicle Type: The make and model of your car affect your insurance rates.

Location: Rates can vary significantly by city and state due to differing traffic patterns and theft rates.

Coverage Levels: The more comprehensive your coverage, the higher your premium.

Meeting State Requirements:

Every state has specific minimum coverage levels mandated by law. To avoid penalties, it’s crucial to ensure your insurance policy meets or exceeds these requirements. OTTO™ makes it simple for you to feel confident about your coverage choices and maintain your peace of mind while driving.

Unlocking Savings:

Take advantage of various discounts offered by insurers, such as those for safe driving records, bundling multiple policies, and installing anti-theft devices in your vehicle. These discounts can help reduce your insurance costs and make your coverage more affordable.

What Kind Of Discounts Are There?

It’s a long list, but here are a few:

• No tickets and/or DUI’s in three years yields big discounts

• Driving less than 20 miles a day lowers your rates

• Safety features, like automatic headlights, are slam dunk discounts

• Key fobs and alarms will reduce your premiums

• Even your ZIP CODE could matter a lot.

Trusting in OTTO™

By understanding these crucial aspects of auto insurance, you’ll be better equipped to navigate the world of insurance with confidence. We know it’s important to carefully consider your specific needs when selecting the types and amounts of auto insurance coverage that’s right for you. OTTO™ is here to help ensure that you and your vehicle are adequately protected. We are committed to helping you find insurance solutions that don’t break the bank.

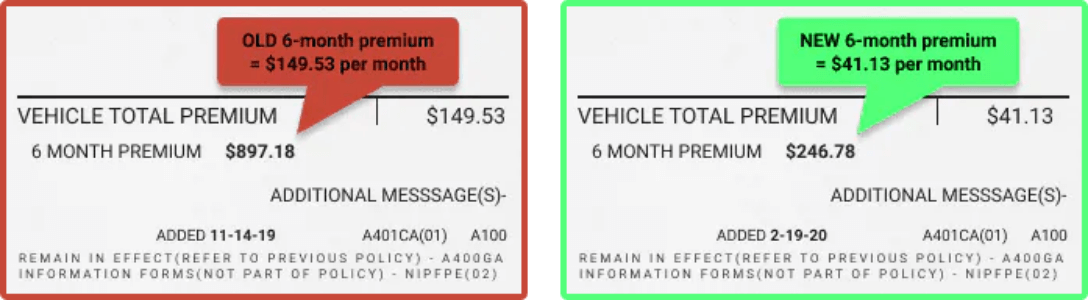

As an authority on everything insurance, OTTO™ decided to put this service to the test and after entering our zip code and driver information we were shocked at this example.

Note: You’re NEVER LOCKED into your current policy. If you’ve already paid your bill, you can very easily cancel, and be refunded your balance. So do not let that stop you from searching for better rates, there is always a way out.

Our tireless customer support team is made up of real people - get a response in seconds. We’re on hand between 9am to 9pm every single day. Let’s have a chat and lock in your savings today.

1-855-771-5002Not feeling up to call in? Don’t worry, we all have days like that and understand. Use the button below to continue online for your quote!

Get Quote Now- $0 Down Payment